Trading

Trades are opened with USDC collateral, regardless of the trading pair. The leverage is synthetic and backed by the USDC vault, and the QQ token.USDC is taken from the pool to pay the traders PNL (if positive) or receives USDC from trades . Their PnL is negative.

Opening / Closing trades

To open and close trades on QIQ you will need:

- A Web3 wallet e.g. Metamask which is connected to QIQ.

- ETH for Arbitrum in that wallet to pay for transaction fees.

- USDC in that wallet to use as collateral.

Note:QIQ is now available on the public testnet! USDC is a token that is exclusively issued by the platform, and it is not equivalent to the USDC tokens that are available on the market. To obtain USDC, you can visit this link: https://rc.qilin.fi/nft/ .

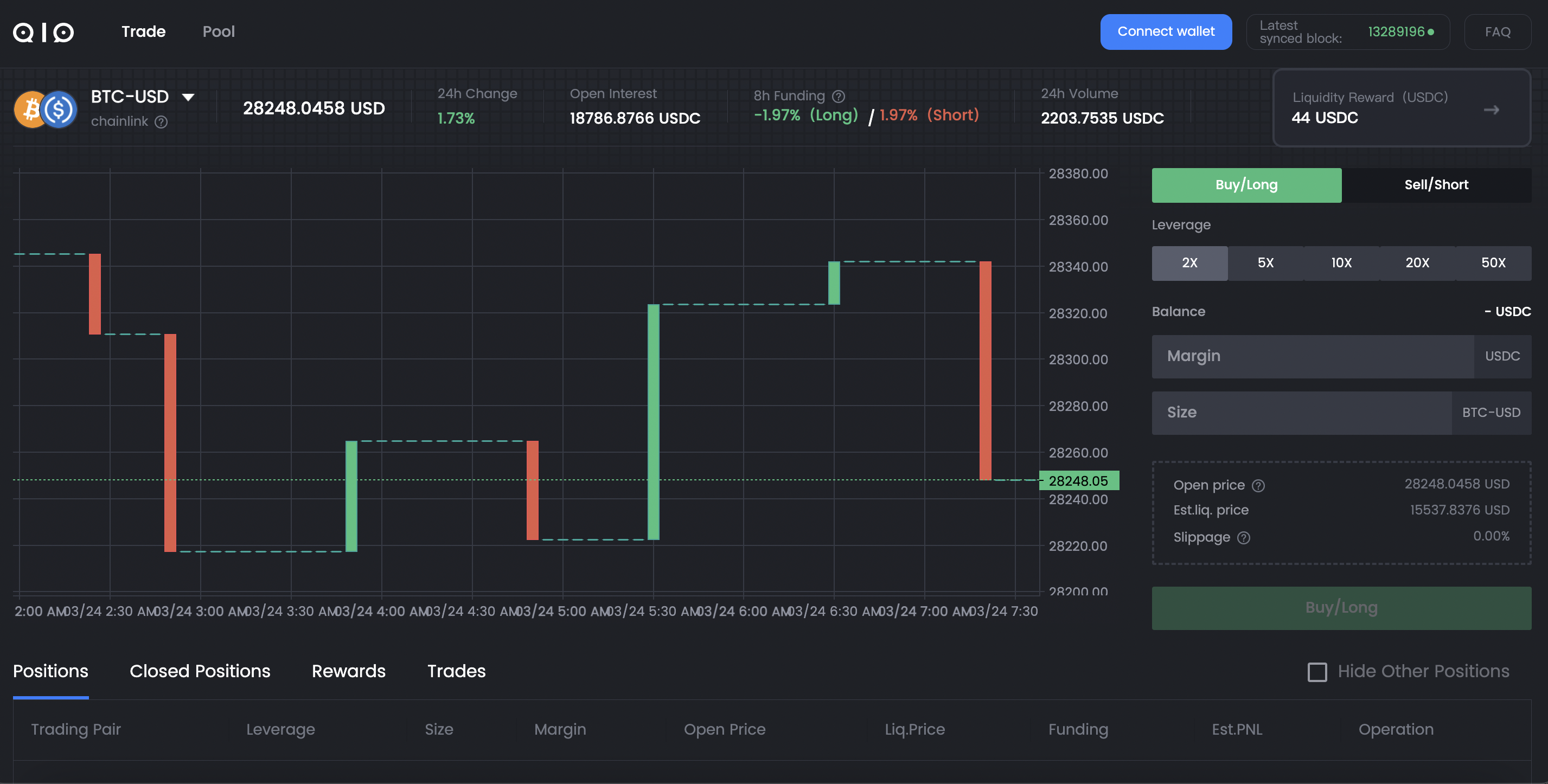

Opening a trade

- Go to our platform.

- Click "Connect Wallet" in the top right. You might need to refresh the page for the website to detect your wallet, if it wasn't unlocked yet.

- If this is your first trade, you will need to approve the contract to be able to use the USDC that you want it to. Click approve and submit the transaction to Arbitrum.

- Select your preferred trading pair from the top left corner.

- Now, you can set your trade parameters: Trade Type and whether it is long (buy) or short (sell).

Open price: To be used to open a trade immediately. It will open at the market price (+ spread).

Collateral: maximum amount you are risking if you are liquidated. Your collateral x leverage must be above the minimum position size. For example on cryptos, it should be above 1,500 USDC. This means you can for example open a trade with 150 USDC collateral at 10x, or with 300 USDC at 5x leverage, etc.

Leverage: multiply the volatility of the price up and down, to increase exposure.

Slippage: It depends on your position.Generally, the larger the position, the greater the slippage. However, there is a maximum limit for slippage, which varies for each trading pair. You can check the "slippage" when opening a position for specific details.

Your Stop Loss. You are not obligated to use a stop loss, but your trade will be liquidated if it is at <= -80% PnL.

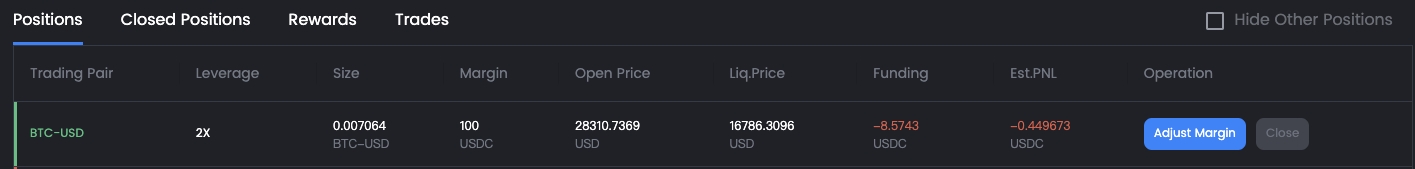

Closing a trade

- Click on the Close to the right hand side of your trade in Your Open Trades.

- Confirm in Metamask to send the closure to Arbitrum.

- Await Trade Closure Confirmation - This is what you receive to your wallet.

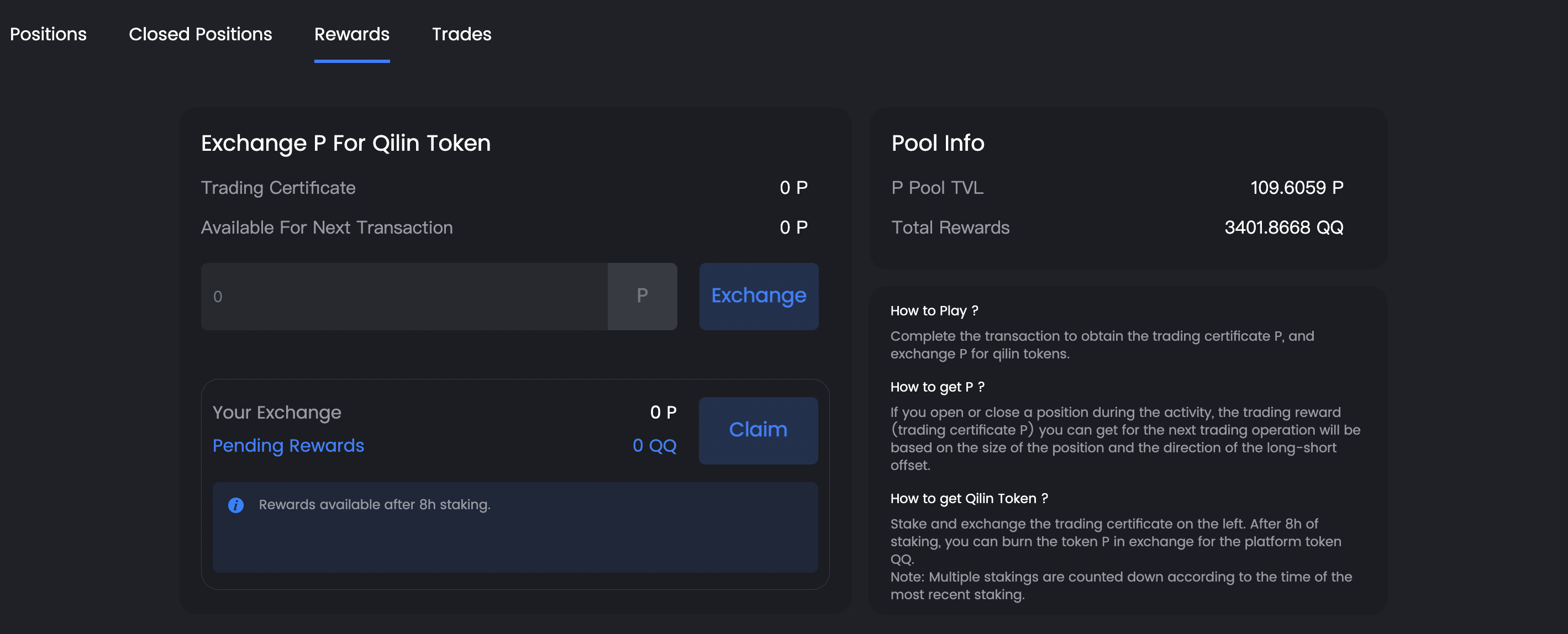

Rewards

How to Play?

Complete the transaction to obtain the trading certificate P, and exchange P for qilin tokens.

How to get P?

If you open or close a position during the activity, the trading reward (trading certificate P) you can get for the next trading operation will be based on the size of the position and the direction of the long-short offset.

How to get Qilin Token(QQ)?

Stake and exchange the trading certificate on the left. After 8h of staking, you can burn the token P in exchange for the platform token QQ.

Note: Multiple stakings are counted down according to the time of the most recent staking.

Liquidity efficiency

Since all trades use the USDC liquidity layer (trading vault), we have a big advantage over other platforms who have to build new liquidity in their order books every time they list a new pair, and maintain high liquidity on each pair.

By building a big USDC vault (with trading fees incentives), every trading pair listed on our platform benefits from bigger position sizes. This means the platform only requires USDC liquidity for ALL pairs that can be traded on the platform.

This is only possible because our architecture doesn't match buying/selling orders using an order book, and because the leverage of trades is "virtual". The PnL is calculated in our smart contracts and settled against the USDC vault.

Powered by Chainlink

While all derivatives platforms generate their own prices through order books or similar models, which often end up in prices that do not correspond to the real spot price of the asset, we use a custom real-time Chainlink node operators network to get the median price for each trading order.

Fee

Service Fee

Traders are required to pay a fee of 0.01% of the position to the liquidity provider as their revenue.

Profit Fee

When a trader makes a profit, a portion of the profit is allocated to the Qilin protocol for the promotion of the platform.

Funding Fee

When there is an imbalance between the long and short positions in the market, the side that has the greater position needs to pay a fee to the side that has the lesser position. This fee is necessary to maintain the balance of the long and short positions in the market as well as the steady progression of the system.You can read more about this here: Funding Fee Rate.

Funding Fee Rate

The Funding Fee Rate mechanism of QIQ is designed to fully adapt to the on-chain environment.

In QIQ, the funding fee is collected from the side which has more funding in the ratio of an open position, and subsidized to the less ratio side. The way in which the funding fee is allocated through positions is determined by both the position size and the duration of the position. The update and collection time is one block, and collecting is through the rebase mechanism.

Mathematical expression

- ΣL: size of the sum of all the long positions

- ΣS: size of the sum of all the short positions

- P: current price

- LP: sum of the total asset value in the liquidity pool

- RT: long-short threshold (system parameter)

- RC: rebase constant (system parameter)

- ΔBlock: block height difference from the previous rebase

- ΣRL: accumulative of long rebase

- ΣRS: accumulative of short rebase

Any action triggers the condition check for rebase:

When the condition is satisfied, the rebase accumulative is calculated:

And the rebase accumulative is updated respectively for long and short:

- ΣL: size of the sum of all the long positions

- ΣS: size of the sum of all the short positions

- ΣAL: size of the coinday of all the long positions

- ΣAS: size of the coinday of all the short positions

- ΔBlock: block height difference from the previously accumulated coinday.

- S: size of the position

- ΔPositionBlock: block height for duration of positions.

- ΣRL: accumulative of long rebase

- ΣRS: accumulative of short rebase

- OR: rebase value at position opening